Sales tax management software is revolutionizing the way businesses handle their tax obligations. With the ever-changing landscape of tax regulations and the increasing complexity of transactions, this software plays a crucial role in ensuring compliance and accuracy. By automating calculations and streamlining processes, organizations can focus more on growth and innovation rather than getting bogged down by tax-related issues.

Over the past decade, sales tax management tools have evolved significantly, incorporating advanced features that enhance usability and integration with existing systems. As businesses face ongoing challenges in tax compliance, understanding the benefits and functionalities of these software solutions has never been more important.

Introduction to Sales Tax Management Software

Sales tax management software plays a pivotal role in modern business operations, ensuring compliance with diverse and frequently changing tax regulations. By streamlining the process of calculating, collecting, and remitting sales tax, these solutions alleviate the burden on finance departments and help organizations avoid costly errors and penalties. As businesses expand across jurisdictions with varying tax laws, the need for effective sales tax management becomes increasingly significant.The key features of effective sales tax management software encompass automation, accuracy, and integration capabilities.

Automation minimizes manual data entry, reducing the risk of human error and enabling businesses to focus on core activities. Accuracy is crucial, as incorrect tax calculations can lead to severe financial repercussions. Integration capabilities allow the software to seamlessly connect with existing accounting and e-commerce systems, providing a holistic view of financial data.

Key Features of Sales Tax Management Software

When evaluating sales tax management software, it’s important to consider features that enhance operational efficiency and compliance. The following features are fundamental for a robust solution:

- Automated Tax Calculation: Automatically calculate sales tax based on the latest regulations, ensuring accuracy across different jurisdictions.

- Real-time Rate Updates: Access to real-time updates for sales tax rates, accommodating changes in tax laws promptly.

- Audit Trail Capabilities: Maintain thorough records of tax calculations and transactions for compliance audits.

- Seamless Integrations: Compatibility with various accounting and e-commerce platforms to facilitate data sharing and streamline operations.

- Reporting and Analytics: Generate detailed reports that provide insights into sales tax obligations and financial performance.

Over the past decade, sales tax management tools have evolved significantly, influenced by the rise of e-commerce and the digital economy. Initially, businesses relied on manual processes or basic software for tax calculations, which were often prone to errors. The introduction of cloud-based solutions has transformed the landscape, enabling businesses to access powerful tools that enhance efficiency and accuracy.Modern sales tax management software now includes advanced features such as artificial intelligence and machine learning, which analyze large datasets to predict tax liabilities and identify compliance risks.

This evolution has allowed businesses to adapt to the increasingly complex tax environment and focus more on strategic growth rather than administrative burdens.

“Effective sales tax management software not only ensures compliance but also empowers businesses to make informed decisions based on accurate financial data.”

Benefits of Using Sales Tax Management Software

Automating sales tax calculations offers several key advantages that can significantly enhance a business’s operational efficiency and compliance with tax regulations. With complexities surrounding sales tax rates and regulations varying by state and locality, businesses require reliable solutions to navigate these challenges effectively. Sales tax management software provides businesses with the tools to simplify this process, reduce human error, and maintain compliance effortlessly.One of the primary benefits of adopting sales tax management software is the automation of sales tax calculations.

This technology ensures that calculations are accurate and up-to-date, reflecting the latest tax rates and regulations. This not only saves time but also reduces the risk of costly errors that can lead to penalties and audits. Moreover, these software solutions can scale with the business, adapting as sales volumes increase or as a company expands into new jurisdictions.

Enhancement of Compliance with Tax Regulations

Compliance with tax regulations is a crucial aspect of operating any business. Sales tax management software enhances compliance through various mechanisms, including:

-

Real-time updates on tax rate changes:

The software automatically updates tax rates based on jurisdiction and product/service classifications, ensuring that businesses are always using the correct rates.

-

Audit readiness:

With comprehensive record-keeping features, businesses can easily access transaction histories and tax calculation logs, making it simpler to prepare for audits.

-

Detailed reporting capabilities:

The software generates detailed reports that help businesses track tax obligations and filing statuses, thus facilitating timely and accurate tax submissions.

Cost-Saving Potential of Implementing Software Solutions

Implementing sales tax management software can yield significant cost savings for businesses, leading to better financial health and resource allocation. The following points illustrate the potential savings:

-

Reduction of penalties and interest:

By ensuring accurate tax calculations and timely submissions, businesses minimize the risk of incurring penalties and interest for late or incorrect tax payments.

-

Decreased labor costs:

Automating the sales tax process reduces the need for dedicated staff to manage tax calculations and filings, allowing employees to focus on other critical business functions.

-

Streamlined operations:

Integration with existing accounting systems means less time spent on manual data entry and reconciliation, ultimately leading to greater efficiency and lower operational costs.

Key Features to Look For

Source: selecthub.com

When selecting sales tax management software, identifying the right features is crucial for optimizing your tax processes. A solid software solution should not only streamline compliance but also enhance your overall financial management. Here’s a closer look at essential features that can significantly impact your operations.

Essential Features Checklist

A comprehensive checklist of features can make it easier to evaluate different sales tax management software options. Here are some key features to consider:

- Automated Tax Calculations – Ensures accurate tax rates are applied based on location and product type.

- Real-Time Updates – Keeps tax rates current with automatic updates to reflect changes in legislation.

- Multi-Jurisdiction Support – Handles tax compliance across various states and localities seamlessly.

- Reporting and Analytics – Offers insights through detailed reports, helping to identify trends and optimize tax strategies.

- User-Friendly Interface – Provides an intuitive experience that promotes easy navigation and reduces training time.

- Integration Capabilities – Connects smoothly with existing accounting systems to streamline workflows.

User-Friendly Interfaces

A user-friendly interface is essential for effective software adoption. When software is designed with the user in mind, it can greatly reduce the learning curve and improve productivity. For instance, an intuitive dashboard allows users to access crucial information quickly, minimizing frustration and enhancing overall efficiency. Simplified navigation and clear labeling of features help ensure that all team members, regardless of technical expertise, can utilize the software effectively.

Integration Capabilities

Integration with existing accounting systems plays a significant role in the efficiency of sales tax management. Software that can connect with platforms such as QuickBooks, Xero, or SAP allows for a seamless flow of data, reducing the need for manual entries and the potential for errors. By integrating sales tax management software with your current systems, you can enhance accuracy and save valuable time.

For example, if your e-commerce platform integrates directly with your tax software, sales data can be automatically pulled to ensure that the correct taxes are calculated, reported, and filed without additional effort.

“Integration capabilities not only streamline processes but also enhance the accuracy of financial reporting.”

Implementation Process

Implementing sales tax management software can significantly streamline your business operations and ensure compliance with tax regulations. This process involves several key steps, each designed to facilitate a smooth transition and maximize the benefits of the software. Understanding the implementation process is crucial for a successful integration into your existing business framework.

Steps for Implementation

The implementation of sales tax management software requires a systematic approach to ensure that all aspects of your business are adequately addressed. Here’s an overview of the steps typically involved in this process:

- Assessment of Needs: Begin by evaluating your current sales tax processes to identify pain points and specific requirements that the software needs to address.

- Selecting the Right Software: Research and select a software solution that aligns with your business size, industry, and specific tax compliance needs.

- Data Migration: Prepare to transfer existing sales tax data into the new system. This step may involve cleaning up old data for accuracy and consistency.

- Setup and Configuration: Install the software and configure it according to your business processes and tax jurisdictions.

- Testing: Conduct thorough testing of the software to ensure that it functions correctly and meets your requirements.

- Go Live: Once testing is complete, transition the software into your daily operations and monitor its performance closely for any issues.

- Feedback and Adjustments: Gather feedback from users and make necessary adjustments to optimize the software’s functionality.

Training Requirements for Staff

Training your staff effectively is essential for the successful use of sales tax management software. Well-informed employees can leverage the software’s capabilities to improve efficiency and compliance. The following aspects should be considered for staff training:

Effective training ensures that staff can navigate and utilize the software to its fullest potential, minimizing errors and improving productivity.

- Initial Training Sessions: Conduct comprehensive training sessions that cover the software’s features, functionalities, and the importance of accurate data entry.

- Ongoing Support: Provide ongoing support through refresher courses or access to resources that help employees troubleshoot common issues.

- Hands-On Practice: Encourage staff to engage in hands-on practice with the software, allowing them to familiarize themselves with its interface and functions before going live.

- Creating User Manuals: Develop user manuals or quick reference guides tailored to your business processes to assist staff in their daily tasks.

Customizing the Software

Customizing sales tax management software to align with your specific business needs can maximize its effectiveness. Here are some tips to achieve that:

Tailoring the software to your business processes ensures that it works seamlessly within your existing operational framework.

- Adjust Tax Settings: Configure tax rates, rules, and jurisdictions specific to your business location and industry.

- Create Custom Reports: Set up custom reporting features to generate insights that are relevant to your business, aiding in strategic decisions.

- User Roles and Permissions: Define user roles and permissions to restrict access to sensitive information while allowing the appropriate teams to perform their tasks.

- Integration with Other Systems: Ensure the software integrates smoothly with existing systems (like accounting or inventory management) to create a cohesive workflow.

Common Challenges and Solutions

Adopting sales tax management software can be a game-changer for businesses, but it doesn’t come without its challenges. Many organizations encounter various issues when implementing these solutions, from integration with existing systems to ensuring compliance with constantly changing tax laws. Recognizing these common hurdles is the first step toward overcoming them and maximizing the benefits of such software.One of the most prevalent challenges businesses face is the complexity of integrating sales tax management software with their current financial and operational systems.

Often, organizations have multiple software solutions in place, and getting them to communicate effectively can be a daunting task. Another challenge is keeping up with the ever-evolving tax regulations, which can vary significantly across different regions, making it critical to ensure accurate compliance. Furthermore, employees may require additional training to utilize these systems effectively, posing another potential roadblock.

Integration and Compatibility Issues

Integrating new software with existing systems can be overwhelming. A lack of compatibility can lead to data silos and inefficiencies. To address these issues, businesses should consider the following solutions:

- Conduct a thorough assessment of existing systems to understand integration points.

- Choose sales tax management software that offers robust integration capabilities with popular ERP and accounting systems.

- Engage with IT professionals or consultants to facilitate a seamless integration process.

Keeping Up with Changing Tax Regulations

The dynamic nature of sales tax laws can lead to compliance risks for businesses. To combat this, organizations can adopt several best practices:

- Opt for software solutions that provide regular updates and automated compliance checks.

- Subscribe to tax news feeds or join professional networks to stay informed on legislative changes.

- Establish a dedicated compliance team to monitor and adapt to these changes proactively.

Employee Training and Change Management

Resistance to new systems can hinder effective utilization of sales tax management software. To promote successful adoption, consider these strategies:

- Implement comprehensive training programs to ensure all team members are confident in using the new software.

- Encourage feedback during the training process to address concerns and improve user experience.

- Designate ‘software champions’ within teams to assist others and facilitate ongoing support.

Importance of Ongoing Support and Updates

Having access to ongoing support from software providers is crucial for long-term success. This includes timely software updates that reflect the latest tax law changes and technical assistance when issues arise. Businesses should ensure their chosen providers offer:

- 24/7 customer support for immediate assistance with technical challenges.

- Regular webinars or training sessions to help users stay updated on new features and best practices.

- Access to a knowledge base or community forum for peer-to-peer support and shared experiences.

Case Studies and Real-World Applications

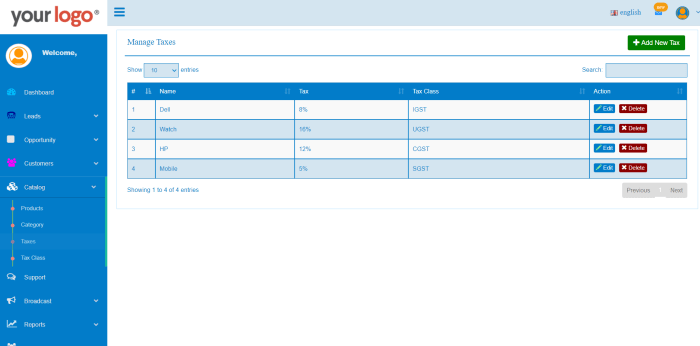

Source: phpcrm.com

Sales tax management software has proven to be a game-changer for many businesses across various industries. Through effective implementation, these companies have streamlined their tax processes, reduced errors, and improved efficiency. Below are examples of organizations that successfully integrated sales tax management software, along with the measurable improvements they observed.

Examples of Successful Implementations

Several companies have adopted sales tax management software, each experiencing distinct benefits. Below are notable examples showcasing the effectiveness of this technology:

- ABC Retail Group: This large retail chain implemented a sales tax management solution to handle its multi-state operations. Post-implementation, they reported a 30% reduction in tax-related discrepancies and a 25% decrease in the time spent on tax calculations, enabling their accounting team to focus on strategic planning.

- XYZ eCommerce: An online retailer faced challenges managing sales tax across various jurisdictions. After deploying a cloud-based sales tax management system, they experienced a 40% increase in compliance accuracy, leading to fewer audits and penalties, ultimately saving them thousands of dollars annually.

- 123 Services LLC: This service-oriented business struggled with manual tax calculations that often led to errors. Upon implementing an automated sales tax management solution, they achieved a 50% decrease in errors, streamlining invoicing and improving customer satisfaction rates significantly.

Measurable Outcomes Post-Implementation

The measurable outcomes following the implementation of sales tax management software illustrate the substantial impact on operational efficiency. Companies have noted several key improvements:

- Time Savings: Businesses have reduced the hours dedicated to sales tax preparation and filing, allowing for reallocation of resources to core business functions.

- Cost Reduction: By minimizing errors and improving compliance, companies have significantly decreased audit risk and associated costs.

- Increased Compliance: With automated updates reflecting the latest tax laws and regulations, businesses have experienced enhanced compliance rates, reducing the likelihood of costly penalties.

- Enhanced Reporting: Improved data analytics and reporting capabilities have provided businesses with better insights into their tax liabilities and trends, supporting strategic decision-making.

Comparison of Different Software Solutions

When evaluating various sales tax management software solutions, it is essential to consider their unique features and capabilities. The following table provides a comparative analysis based on the experiences of businesses that have implemented these tools:

| Software Solution | Key Features | Industry Application | Average Cost |

|---|---|---|---|

| Solution A | Real-time calculations, automated updates, multi-jurisdictional support | Retail, eCommerce | $$$ |

| Solution B | Customizable reporting, integration with accounting software | Service, Manufacturing | $$ |

| Solution C | Comprehensive audit support, extensive training resources | Wholesale, Distribution | $$$$ |

Businesses have found that selecting the right sales tax management software can lead to significant operational gains and improved compliance. By leveraging the experiences of others, organizations can make informed decisions that enhance their tax management processes.

Future Trends in Sales Tax Management

As businesses continue to evolve amidst rapid technological advancements and globalization, the landscape of sales tax management is also transforming. This section delves into the future trends that are expected to shape sales tax management software, providing insights into emerging technologies, the influence of global commerce, and potential regulatory shifts that may impact tax solutions in the years to come.

Emerging Technologies Shaping Sales Tax Management, Sales tax management software

Innovative technologies are significantly influencing how sales tax management software operates. Here are some key technologies that are transforming this field:

- Artificial Intelligence and Machine Learning: AI and machine learning are revolutionizing data analysis within sales tax management. These technologies can enhance predictive analytics to better forecast tax obligations and identify tax-saving opportunities.

- Blockchain: The adaptability of blockchain technology can streamline transaction verification and ensure transparency. This can simplify compliance in environments with complex tax obligations through immutable records.

- Robotic Process Automation (RPA): RPA can automate repetitive tasks such as data entry and reconciliation, allowing tax professionals to focus on strategic decision-making rather than mundane processes.

- Cloud Computing: Cloud-based platforms are increasingly preferred for their scalability, accessibility, and reduced IT overhead. These solutions allow for real-time updates and collaboration, essential for managing dynamic tax environments.

Impact of Globalization on Sales Tax Management Solutions

The rise of globalization has introduced complexities in sales tax management. Companies are now operating across multiple jurisdictions, which necessitates a sophisticated approach to compliance. The following points highlight the impact of globalization on sales tax management:

- Cross-Border Transactions: Managing sales tax in cross-border transactions requires an understanding of varying tax rates and regulations in different countries, emphasizing the need for robust software solutions.

- Diverse Regulatory Environments: Each country has its unique tax laws, necessitating software capable of adapting to different compliance requirements, hence spurring innovation in tax technology.

- Increased Audit Risk: Operating in multiple countries raises the stakes for audits. Companies must ensure they are equipped with accurate reporting tools to minimize risks associated with non-compliance.

Potential Regulatory Changes Affecting Sales Tax Software

As tax regulations continue to evolve, sales tax management software must adapt to stay compliant. Anticipated regulatory changes that may impact sales tax software include:

- Digital Tax Regulations: With the increasing digitalization of the economy, several countries are implementing or considering digital services taxes on foreign tech companies, which could lead to the need for specialized tax software.

- Changes in Nexus Laws: As states refine their nexus laws, particularly post-Wayfair decision, sales tax software must evolve to help businesses accurately assess their tax liabilities based on economic presence.

- VAT/GST Reforms: Global shifts towards more uniform VAT/GST regulations can lead to significant changes in compliance requirements, compelling software developers to enhance their solutions accordingly.

Outcome Summary

In summary, the adoption of sales tax management software offers numerous advantages that can lead to significant improvements in operational efficiency and regulatory compliance. As emerging technologies continue to shape the future of tax management, businesses that proactively implement these solutions will be better positioned to navigate the complexities of sales tax in an increasingly globalized market. The right software not only simplifies tax processes but also empowers organizations to make informed decisions for long-term success.

Clarifying Questions: Sales Tax Management Software

What is sales tax management software?

It is a tool designed to automate and streamline the calculation, reporting, and compliance of sales tax for businesses.

How can sales tax management software save costs?

By automating tax calculations and reducing errors, it minimizes the risk of penalties and helps in optimizing tax processes, saving time and resources.

Is training required for using sales tax management software?

Yes, staff training is often necessary to ensure effective use and maximize the software’s capabilities.

Can sales tax management software integrate with my existing system?

Most solutions offer integration capabilities with popular accounting and ERP systems, making implementation smoother.

What are the common challenges in implementing such software?

Common challenges include resistance to change, compatibility issues with existing systems, and lack of sufficient training.

How often should the software be updated?

Regular updates are essential to keep up with changing tax regulations and to improve functionality.