Billing software for small business is revolutionizing how entrepreneurs manage their finances, offering efficient solutions that streamline invoicing and payment processes. With the right billing software, small businesses can save time and reduce errors, freeing up valuable resources to focus on growth and customer satisfaction.

This technology is designed to simplify billing tasks, ensuring accurate tracking of transactions and providing essential features like reporting, analytics, and integration with other business tools. As we delve deeper, we will explore the features, types, and key considerations for selecting the ideal billing software tailored to meet the unique needs of small businesses.

Overview of Billing Software for Small Business

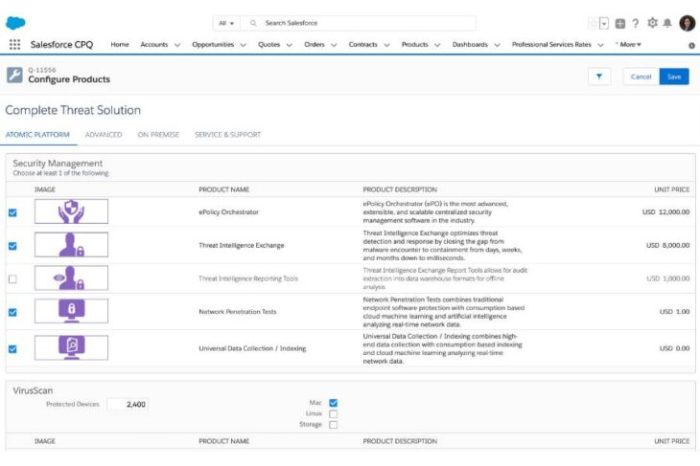

Source: fitsmallbusiness.com

Billing software is designed to streamline the invoicing and payment processes for small businesses, providing them with the tools needed to manage their financial transactions efficiently. This type of software is essential for small businesses as it helps save time and resources, reduces errors, and enhances cash flow management. By automating billing processes, small business owners can focus more on their core operations instead of being bogged down by administrative tasks.Common features of billing software typically include invoicing, payment processing, expense tracking, reporting, and customer management.

These features collectively benefit small businesses by providing a comprehensive solution for managing their finances. For instance, automated invoicing reduces the chances of human error, while real-time reporting allows business owners to have a clear view of their financial standing. Such tools can significantly enhance operational efficiency and customer satisfaction.

Features of Billing Software and Their Benefits

Understanding the specific features of billing software can help small businesses recognize their value and utility. The following features and their corresponding benefits illustrate how billing software can transform financial management:

- Automated Invoicing: This feature allows for the creation and sending of invoices automatically, which eliminates manual entry errors and ensures timely billing.

- Payment Processing: Integrated payment gateways facilitate quick and secure transaction processing, enabling businesses to receive payments faster.

- Expense Tracking: This function helps businesses monitor their expenses in real-time, providing insights into spending habits and aiding budget management.

- Reporting and Analytics: Comprehensive reporting tools offer insights into sales trends, cash flow, and customer behavior, assisting in informed decision-making.

- Customer Management: Effective management of customer information enables businesses to build stronger relationships and improve customer service.

Differences Between Billing Software and Traditional Invoicing Methods

Billing software differs significantly from traditional invoicing methods, which often rely on manual processes and paperwork. The advantages of using billing software over conventional methods can be summarized as follows:

Billing software offers automation, accuracy, and ease of access, paving the way for more efficient financial operations.

Traditional invoicing methods can be time-consuming and prone to errors due to manual entry. In contrast, billing software automates these processes, reducing the likelihood of mistakes. Furthermore, traditional methods involve physical paper trails and storage, while billing software enables digital storage and cloud-based access, ensuring that invoices and financial data are readily available and securely stored.Additionally, billing software often provides features such as recurring billing, which is not possible with manual invoicing.

This is particularly beneficial for subscription-based businesses, as it allows for seamless payments and improves cash flow predictability. The efficiency gained from transitioning to billing software can lead to enhanced customer satisfaction and a more organized financial management system.

Types of Billing Software

Billing software is essential for small businesses to streamline their financial processes, manage invoices, and maintain accurate records. With a variety of options available, businesses can choose the software that best suits their needs, whether they are looking for a simple invoicing tool or a comprehensive financial management system. Understanding the different types of billing software can help business owners make informed decisions, ensuring a smooth billing process that enhances efficiency.There are two primary categories of billing software: cloud-based solutions and on-premise systems.

Each option comes with its own set of advantages and considerations that can significantly impact how small businesses operate.

Cloud-Based vs. On-Premise Billing Solutions

Choosing between cloud-based and on-premise billing software is a critical decision for small business owners. Each type has its unique features that cater to different business needs.Cloud-based billing software is hosted on the vendor’s servers and accessed via the internet. This option tends to offer flexibility and scalability, allowing businesses to access their data from anywhere, at any time. Key benefits of cloud-based solutions include:

- Automatic updates and maintenance

- Lower initial setup costs

- Scalability as the business grows

- Enhanced collaboration with team members

In contrast, on-premise billing software is installed directly on the business’s hardware and is managed in-house. While this option can provide greater control over data, it often comes with higher initial costs and ongoing maintenance expenses. Important considerations include:

- One-time purchase cost with potential for high setup fees

- Requires IT support for maintenance and updates

- Data security managed by the business

- Potential limitations on access and scalability

Ultimately, the choice between cloud-based and on-premise solutions will depend on the specific needs and resources of the business.

Industry-Specific Billing Software Options

For small businesses operating in niche markets, industry-specific billing software can offer tailored features that address unique billing requirements and regulatory compliance. This specialized software often includes functionalities that cater to the distinct workflows found within certain industries.Examples of industry-specific billing software include:

- Healthcare Billing Software: Designed for medical practices, this software handles insurance claims, patient billing, and maintains compliance with healthcare regulations such as HIPAA.

- Construction Billing Software: This type offers features for project management, job costing, and progress invoicing, making it ideal for contractors and construction firms.

- Membership Billing Software: Used by gyms and subscription-based services, this software automates recurring billing and membership management.

- Legal Billing Software: Tailored for law firms, it includes time tracking, expense management, and trust accounting features.

Selecting industry-specific billing software not only simplifies the billing process but also ensures compliance with industry standards and regulations, ultimately enhancing operational efficiency.

Key Features to Look For

When selecting billing software for a small business, it’s crucial to identify features that not only streamline the billing process but also enhance overall efficiency. This software should cater to the unique needs of small businesses, ensuring that managing finances is straightforward and effective. A user-friendly interface is paramount, as it allows business owners and employees to navigate the software without unnecessary complications.

Integration capabilities with existing tools, such as accounting software or CRM systems, further enhance operational efficiency by ensuring that all systems work seamlessly together.

Essential Features for Billing Software

Here’s a list of essential features that small businesses should prioritize when choosing billing software:

- Automated Invoicing: The ability to automatically generate and send invoices saves time and reduces human error. For instance, software like FreshBooks allows users to set up recurring billing for subscription-based services.

- Payment Processing: Choose software that supports various payment methods, including credit cards, bank transfers, and online payment gateways, making it easier for customers to pay.

- Multi-Currency Support: For businesses dealing with international clients, having the option to bill in different currencies can enhance customer satisfaction.

- Expense Tracking: This feature helps in monitoring business expenditures and integrating them with billing, which can be vital for financial planning.

- Customizable Invoice Templates: The ability to personalize invoices can help maintain brand consistency and professionalism.

- Client Portal: Offering clients a space to view and pay their invoices online can streamline the payment process and improve cash flow.

- Reporting and Analytics: Advanced reporting features provide insights into sales trends and customer behavior, which can be vital for strategic planning.

User-Friendly Interfaces and Integration Capabilities

The importance of a user-friendly interface cannot be overstated, especially for small businesses where employees may not have extensive technical training. A clean, intuitive design allows users to focus on their work rather than spending time learning how to navigate complex software. Integration capabilities are equally important, as they allow billing software to work harmoniously with other essential business tools.

For example, if the billing software can easily integrate with accounting platforms like QuickBooks or Xero, it eliminates the need for duplicate data entry, reduces errors, and enhances overall productivity across departments.

Reporting and Analytics Features

Robust reporting and analytics features in billing software can significantly enhance billing processes. These tools provide businesses with critical insights that guide financial decisions. For instance, analytical tools may offer:

- Sales Reports: Detailed insights into revenue generation over specific periods, helping businesses understand their performance and make informed decisions.

- Customer Insights: Analytics on customer payment habits, highlighting which clients pay on time and which may require follow-ups.

- Expense Reports: A breakdown of expenditures can assist in budget management and highlight areas where costs can be reduced.

“Effective analytics transform billing software from a simple tool into a strategic asset for growth.”

These powerful features not only simplify the billing process but also empower small businesses to make data-driven decisions that can lead to sustainable growth.

Cost Considerations: Billing Software For Small Business

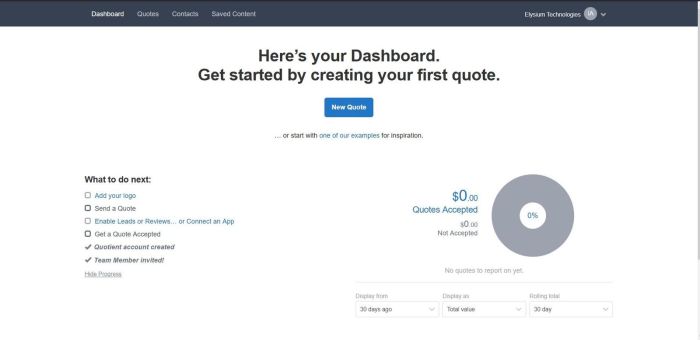

Source: toksta.com

When selecting billing software for small businesses, understanding the cost implications is essential. It’s not just about the sticker price; various factors can influence your overall investment. Evaluating the different pricing models and potential hidden expenses can help ensure you choose a solution that aligns with your budget and business needs.

Pricing Models for Billing Software

Billing software typically operates under two main pricing models: subscription and one-time payment. Subscription models often charge a monthly or annual fee, granting access to the software, updates, and customer support. This can be advantageous for small businesses as it allows for more manageable budgeting and ensures users always have the latest features. However, over time, these costs can accumulate, potentially leading to a higher total expenditure compared to a one-time purchase.In contrast, one-time payment models require a larger upfront investment but may save money in the long run.

Users own the software outright and tend not to incur ongoing fees, although they might need to pay for updates or support separately. Consider these factors when evaluating pricing models:

- Budget constraints: Analyze whether your business can handle a one-time payment or if a subscription is more feasible.

- Long-term needs: Determine whether you will need ongoing updates and support that may justify a subscription.

- Scalability: Assess if the software can grow with your business, which might impact costs over time.

Comparing Costs of Popular Billing Software Options

The landscape of billing software offers many options, each varying in price and features. Some popular choices for small businesses include:

| Software Name | Pricing Structure | Key Features |

|---|---|---|

| FreshBooks | Starting at $15/month | Invoicing, time tracking, expense management |

| QuickBooks Online | Starting at $25/month | Accounting, invoicing, tax preparation |

| Xero | Starting at $12/month | Invoicing, bank reconciliation, financial reporting |

Evaluating these costs against the features offered can help small businesses identify the best value for their specific needs. For example, while QuickBooks Online is more expensive, it provides extensive accounting capabilities that might be vital for some businesses.

Potential Hidden Costs of Billing Software

While upfront costs are essential, hidden expenses can significantly impact the total cost of ownership of billing software. Businesses should remain vigilant for the following potential hidden costs:

- Transaction fees: Some software charges additional fees for payment processing, which can add up depending on transaction volume.

- Upgrade fees: Certain platforms may require payment for access to new features or modules that become necessary as the business grows.

- Integration costs: Integrating billing software with existing systems may require additional investments in development or third-party services.

- Training and support: While some software includes customer support, advanced training may incur extra charges, especially if staff requires extensive onboarding.

By proactively identifying and accounting for these potential hidden costs, businesses can avoid surprises and make more informed budgeting decisions regarding their billing software.

Implementation and Setup

Implementing billing software in a small business can streamline operations, improve accuracy, and enhance customer service. The process may seem daunting at first, but with a clear plan and understanding of the necessary steps, you can achieve a seamless integration. This section Artikels the steps involved in setting up billing software effectively, along with common challenges and strategies for overcoming them.

Steps to Implement Billing Software

The implementation of billing software involves several key steps that ensure a successful setup. Understanding each phase can help mitigate potential pitfalls.

- Assess Your Needs: Identify the specific requirements of your business. Consider the volume of transactions, customer types, and integration with existing systems.

- Choose the Right Software: Select a billing solution that aligns with your business needs. Review features, usability, and customer support options.

- Plan the Implementation: Create a timeline outlining the phases of the implementation. Include milestones and deadlines to keep the project on track.

- Data Migration: Prepare to transfer existing data into the new system. Ensure the data is clean and organized to avoid errors during the migration.

- System Configuration: Customize the software settings according to your business requirements. This includes setting up payment methods, tax rates, and invoice templates.

- Training Staff: Conduct training sessions for employees to ensure they are familiar with the new system. Offer resources and support as they learn.

- Testing: Run a series of tests to detect any issues before going live. Verify that all functions, from invoicing to payment processing, work as intended.

- Go Live: Launch the software in a real-world setting. Monitor its performance closely during the initial phase to quickly address any issues that arise.

Checklist for Setting Up Billing Software

Having a checklist can significantly enhance the setup process by ensuring all necessary steps are covered. Below is a comprehensive checklist to guide your implementation.

- Define business requirements and expectations.

- Select billing software based on features and compatibility.

- Establish a clear timeline and project plan.

- Prepare existing data for migration (clean and organize).

- Customize software settings appropriately.

- Train staff on the use of the new software.

- Conduct thorough testing of all functionalities.

- Monitor performance and gather feedback post-implementation.

Common Challenges and Solutions

During the implementation of billing software, small businesses may encounter various challenges. Acknowledging these issues and knowing how to address them can lead to a smoother transition.

Common challenges include data migration errors, staff resistance to change, and integration issues with existing systems.

- Data Migration Errors: To minimize errors, double-check data accuracy before migration and utilize software tools designed for this purpose.

- Staff Resistance: Engage employees early in the process, highlight the benefits of the new system, and provide comprehensive training to ease transitions.

- Integration Issues: Choose billing software with robust APIs or built-in integration capabilities to ensure seamless connectivity with other business applications.

- Ongoing Support: Establish a reliable support system for users to address ongoing questions and technical issues as they arise.

Integration with Other Business Tools

Source: cloudsmallbusinessservice.com

Billing software for small businesses doesn’t operate in a vacuum; it interacts with a variety of other business tools to create a seamless operational experience. This integration can enhance efficiency, reduce errors, and foster better financial management. By connecting billing software with accounting platforms, payment processors, and inventory management systems, businesses can ensure that their financial data is accurate, up-to-date, and easily accessible.Integrating billing software with other business tools allows for streamlined operations and improved workflow.

For instance, when billing software is linked with accounting platforms, it eliminates redundant data entry, reduces the risk of human error, and enables real-time financial tracking. Payment platforms can also be integrated to facilitate easier payment processing, making it simple for customers to pay their invoices directly online. Additionally, synchronizing billing software with inventory management systems provides businesses with a comprehensive view of their financial health and stock levels, ensuring better decision-making.

Integration with Accounting and Payment Platforms

Integrating billing software with accounting and payment platforms is crucial for maintaining accurate financial records. This integration helps businesses automate numerous processes, such as invoicing, payment tracking, and financial reporting. By syncing these systems, companies can achieve the following benefits:

- Real-Time Data Synchronization: Financial data is updated instantaneously, providing a clear and current view of a business’s financial status.

- Reduced Manual Entry: The integration minimizes the need for manual data entry, which can lead to errors and inefficiencies.

- Streamlined Payment Processing: Customers can easily pay invoices through integrated payment platforms, enhancing cash flow and customer satisfaction.

Popular accounting platforms that integrate well with billing software include QuickBooks, Xero, and FreshBooks. These platforms seamlessly connect to various billing solutions, providing small businesses with a unified financial management system.

Benefits of Syncing with Inventory Management Systems

Connecting billing software with inventory management systems is essential for businesses that handle physical products. This integration can create numerous efficiencies that positively impact overall operations. Here are key benefits of this integration:

- Accurate Stock Levels: Real-time updates on inventory levels help prevent stockouts and overselling, ensuring customers are satisfied with their purchases.

- Integrated Sales Data: Linking sales data with inventory management enables better forecasting and planning, allowing businesses to make informed purchasing decisions.

- Improved Cash Flow Management: By having an accurate picture of inventory on hand and what needs to be ordered, businesses can manage cash flow more effectively.

Examples of inventory management systems that work well with billing solutions include TradeGecko, Zoho Inventory, and Cin7. These integrations provide small businesses with enhanced functionality and greater insight into their operations.

Examples of Software Pairings for Enhanced Functionality

Several software solutions enhance the functionality of billing software when integrated effectively. Here are notable examples:

- Stripe: A payment processing platform that integrates smoothly with various billing software, allowing for easy online payments.

- Square: Offers both point-of-sale and billing functionalities, providing a cohesive system for businesses with physical and online sales.

- Shopify: E-commerce platform that syncs with billing software to streamline order processing and billing management for online retailers.

These integrations not only facilitate easier operations but also empower small businesses to maintain better control over their finances. By leveraging these connections, businesses can create a well-rounded operational infrastructure that supports their growth and success.

Security and Compliance

For small businesses, the importance of data security in billing software cannot be overstated. With an ever-increasing number of cyber threats and financial regulations, safeguarding sensitive information is crucial not only for the reputation of the business but also for maintaining customer trust. Small businesses often operate with limited resources, making them attractive targets for cybercriminals. Therefore, selecting billing software with robust security measures is essential to protect both financial data and customer information.Compliance with financial regulations and standards is vital for small businesses utilizing billing software.

Different regions have specific laws governing the handling of financial information, such as the General Data Protection Regulation (GDPR) in Europe and the Payment Card Industry Data Security Standard (PCI DSS) globally. These regulations Artikel the necessary protocols to secure payment data and customer information, ensuring that businesses follow best practices in data protection. Failing to comply can lead to heavy fines, legal actions, and loss of customer confidence.

Best Practices for Securing Billing Information and Customer Data

Implementing best practices for securing billing information and customer data is imperative for small businesses. Here are key strategies to enhance security:

- Data Encryption: Always ensure that billing software uses strong encryption protocols to protect sensitive information during transmission and storage. This makes it difficult for unauthorized users to access the data even if they manage to breach the system.

- Access Controls: Limit access to billing software to authorized personnel only. Utilize role-based access controls to ensure that employees have access only to the information necessary for their roles.

- Regular Software Updates: Keep the billing software and all associated systems up to date with the latest security patches. Cybercriminals often exploit vulnerabilities in outdated software, making regular updates a critical component of security.

- Backup Data: Regularly back up billing information and customer data to a secure location. In the event of a data breach or system failure, having reliable backups can significantly minimize the impact on business operations.

- Two-Factor Authentication: Implement two-factor authentication (2FA) for accessing billing software. This adds an extra layer of security, requiring users to verify their identity through a second method beyond just a password.

- Employee Training: Regularly train employees on cybersecurity best practices and recognize phishing attempts. Employees are often the first line of defense against cyber threats, so ensuring they are informed and vigilant is essential.

“Data security is not just a technology issue; it is a business imperative that can protect your company’s reputation and customer trust.”

User Experiences and Case Studies

In the realm of billing software, real-world experiences often highlight the tangible benefits these tools bring to small businesses. By examining success stories and hypothetical scenarios, we can better understand how billing software transforms operations and resolves persistent challenges.

Success Stories of Small Businesses

Many small businesses have successfully integrated billing software into their operations, leading to substantial improvements in efficiency and accuracy. For instance, a local graphic design firm saw a 40% reduction in billing errors after implementing a comprehensive billing software solution. This not only streamlined their invoicing process but also improved client relationships through timely and accurate billing. Another success story comes from a small retail store that was struggling with managing its inventory and sales data.

After adopting billing software that included inventory management features, the business experienced a significant increase in sales tracking efficiency. The integration allowed for real-time inventory updates, enabling the store to maintain optimal stock levels and reduce losses due to overstocking or stockouts.

Hypothetical Scenarios

Consider a small landscaping company that faced difficulties in tracking billable hours for projects. The owner often estimated time spent on tasks, leading to inconsistent billing that frustrated clients. By implementing a billing software solution that tracked time automatically, the owner could generate precise invoices based on actual hours worked. This clarity not only enhanced customer trust but also improved cash flow, as clients appreciated the transparency in billing.In another scenario, a freelance writer struggled to keep track of multiple projects and their respective payments.

After adopting billing software with project management features, the writer could easily monitor deadlines and payments. The software provided reminders for overdue invoices, ensuring timely payments and allowing the writer to focus more on creating content rather than chasing payments.

User Feedback and Reviews, Billing software for small business

User feedback plays a crucial role in assessing the effectiveness of billing software platforms. Many users commend platforms for their ease of use and customer support. For example, users often highlight the intuitive interface of certain billing software, making it accessible even for those not well-versed in technology. On the other hand, some reviews point out challenges such as integration issues with existing systems.

Users have expressed the importance of a smooth onboarding process, as any complications can lead to frustration and decreased productivity. According to reviews on various software comparison sites, businesses that prioritize training and support during implementation report higher satisfaction rates.

“The right billing software doesn’t just save time; it builds stronger relationships with clients through transparency and accuracy.”

Future Trends in Billing Software

As technology continues to evolve, billing software is expected to undergo significant transformations. Small businesses must stay ahead of these trends to optimize their billing processes and enhance customer experiences. The incorporation of advanced technologies and the changing needs of businesses will shape the future landscape of billing solutions.The advent of artificial intelligence (AI) and automation is set to revolutionize billing processes, making them faster, more efficient, and less prone to errors.

These technologies can streamline operations, reduce the need for manual input, and improve data accuracy. As small businesses adopt these innovations, they will not only save time but also allocate resources more effectively, allowing for strategic growth.

Emerging Trends in Billing Software Technology

Several trends are emerging in the billing software sphere that small businesses need to monitor closely. These include:

- AI Integration: Billing software increasingly utilizes AI to analyze customer data, predict payment behaviors, and enhance decision-making.

- Automated Invoicing: Automation tools reduce manual entry and ensure timely invoicing, which helps maintain cash flow and improves efficiency.

- Cloud-Based Solutions: Cloud technology allows for remote access, scalability, and real-time updates, making it easier for businesses to manage billing from anywhere.

- Mobile Compatibility: With the rise of mobile technology, billing software is now optimized for smartphones, allowing business owners to manage invoicing on the go.

- Subscription Billing Models: More businesses are shifting to subscription-based services, necessitating billing software that can handle recurring payments seamlessly.

Impact of Automation on Billing Processes

The impact of automation on billing processes cannot be overstated. It significantly enhances operational efficiency and improves the overall customer experience. Automated systems can generate invoices, send reminders, and even manage payment collections without human intervention. This not only speeds up the billing cycle but also minimizes the chances of human error.

“The future of billing lies in automation—the quicker and more accurate your billing process, the better your cash flow management.”

Challenges Small Businesses May Face

While the future of billing software appears promising, small businesses may encounter several challenges:

- Technology Adaptation: Transitioning to new billing technologies requires time and training, which can be daunting for smaller teams.

- Cost of Implementation: Investing in advanced billing software can be a significant upfront expense, posing a challenge to cash-strapped businesses.

- Data Security Concerns: As billing processes become more digitized, the risk of data breaches increases, requiring businesses to prioritize security measures.

- Regulatory Compliance: Keeping up with changing regulations related to billing practices can pose an ongoing challenge for compliance.

- Integration Issues: Ensuring that new billing software integrates seamlessly with existing systems can be complex and may require additional resources.

Ultimate Conclusion

In conclusion, embracing billing software for small business can significantly enhance operational efficiency and financial management. By understanding the various options available and the key features that cater to specific needs, small business owners can make informed decisions that not only improve their billing processes but also support their overall growth objectives.

Questions Often Asked

What is billing software?

Billing software is a tool that automates the invoicing process, tracks payments, and manages financial transactions for businesses.

How does billing software differ from manual invoicing?

Billing software automates the invoicing process, reducing errors and saving time compared to manual invoicing methods.

Can billing software integrate with other tools?

Yes, many billing software options can integrate with accounting, payment platforms, and inventory management systems for enhanced functionality.

What are hidden costs associated with billing software?

Hidden costs may include transaction fees, additional user licenses, or costs for add-on features not included in the initial pricing.

Is billing software secure?

Most billing software prioritizes data security, implementing encryption and compliance with financial regulations to protect sensitive information.

What features should I prioritize in billing software?

Look for user-friendly interfaces, integration capabilities, reporting tools, and customer support when selecting billing software.

How long does it take to implement billing software?

The implementation time can vary based on the software and business size but typically ranges from a few days to a couple of weeks.